I’ll bet many of you are doing your income tax returns right now. It is that lovely time of year. Income taxes. A topic that elicits strong emotion and, when filling out the returns, anxiety.

I’ll bet many of you are doing your income tax returns right now. It is that lovely time of year. Income taxes. A topic that elicits strong emotion and, when filling out the returns, anxiety.

Did you know they had income taxes in the Regency?

Income taxes were first implemented in Great Britain in 1798 by William Pitt the Younger in order to pay for the impending war with Napoleon. It was a graduated income tax starting at 2 old pence in the pound for incomes over 60 pounds per year and rising to 2 shillings in the pound on incomes over 200 pounds.

This income tax was abolished in 1802 after the Peace of Amiens, but a new one was voted in in 1803, again because of the Napoleonic War. It wasn’t called an income tax, though. It was called a ‘contribution of the profits arising from property, professions, trades and offices,’ but, basically, it was an income tax.

Like our taxes, it even had different ‘Schedules.’ Schedule A was a tax on income from UK land. Schedule B, from commercial occupation of land. Schedule c was a tax on income from public securities. Schedule D was tax on trading income, income from professions and vocations, interest, overseas income and casual income (whatever that is!). Lastly, Schedule E was a tax on employment income.

The maximum tax rate seems minuscule to ours in the present day. It was only 5%, but, like all income taxes, it was very unpopular. After its repeal in 1816 Parliament ordered the destruction of all documents connected with it. This was all for show, though. The King’s Remembrancer made duplicates.

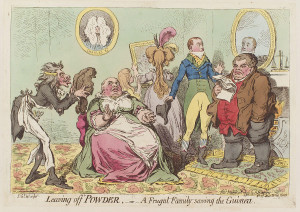

Never fear, though. During that time there were many other taxes for the citizenry to complain about. Taxes on windows and glass, on servants, on carriages, on owning a dog (the more dogs, the more tax). And, of course, the tax on hair powder, which did its part in making that practice go out of fashion.

Winner of the Wellington (abridged) biography by Elizabeth Longford, in honor of The Duke of Wellington Tour, is……Louisa Cornell!! Louisa, I’ll be in touch by email.

Winner of the Wellington (abridged) biography by Elizabeth Longford, in honor of The Duke of Wellington Tour, is……Louisa Cornell!! Louisa, I’ll be in touch by email.

So, who is having fun with taxes today?????

(By the way, I was quoted in a lovely blog post about Harlequin Historical on the USA Today Happy Ever After Blog!)

I’m having the time of my life with taxes today! (Did that sarcasm come through?) Let’s see–I have to file a paper return because my SSN was already used by a thief to file a tax return, my husband took a new job in Nov so we have to split state income tax, except we moved from a state with no income tax to a state WITH income tax so it’s even messier and trickier, plus I’m claiming my writing expenses/income (loss really) for the first time. I sense an audit coming on:-)

Huzza – Congratulations, Louisa. I know you’re going to enjoy reading about the Duke!

Well done, Louisa! Something to rejoice in the day. 🙂

Congrats Louisa! Enjoy reading.

Us Aussies don’t have to worry about taxes until much later. Our financial year ends 30 June, which makes our Tax Day a very appropriate 31 October.

hahaha. I love that!!!

Oh I think our tax day should be October 31 st! Or perhaps April 1st! Sheesh! I got mine done under the wire and I had to pay. I need social security numbers for my dogs!

And I am SO excited to have won the Wellington book. I know I will enjoy reading about Diane and Kristine’s historical boyfriend. You didn’t hear it from me, but those ladies can get pretty violent about Artie! Thanks so much, O Divine One!